If a storm just swept through and left your roof in rough shape, you’re probably wondering what to do next. For many Georgia homeowners, filing a roof insurance claim feels complicated and unclear. We get calls every week from folks in your shoes, and the truth is, this process doesn’t have to be stressful.

This guide will walk you through exactly what to do, step by step, so you can protect your home and move forward with confidence.

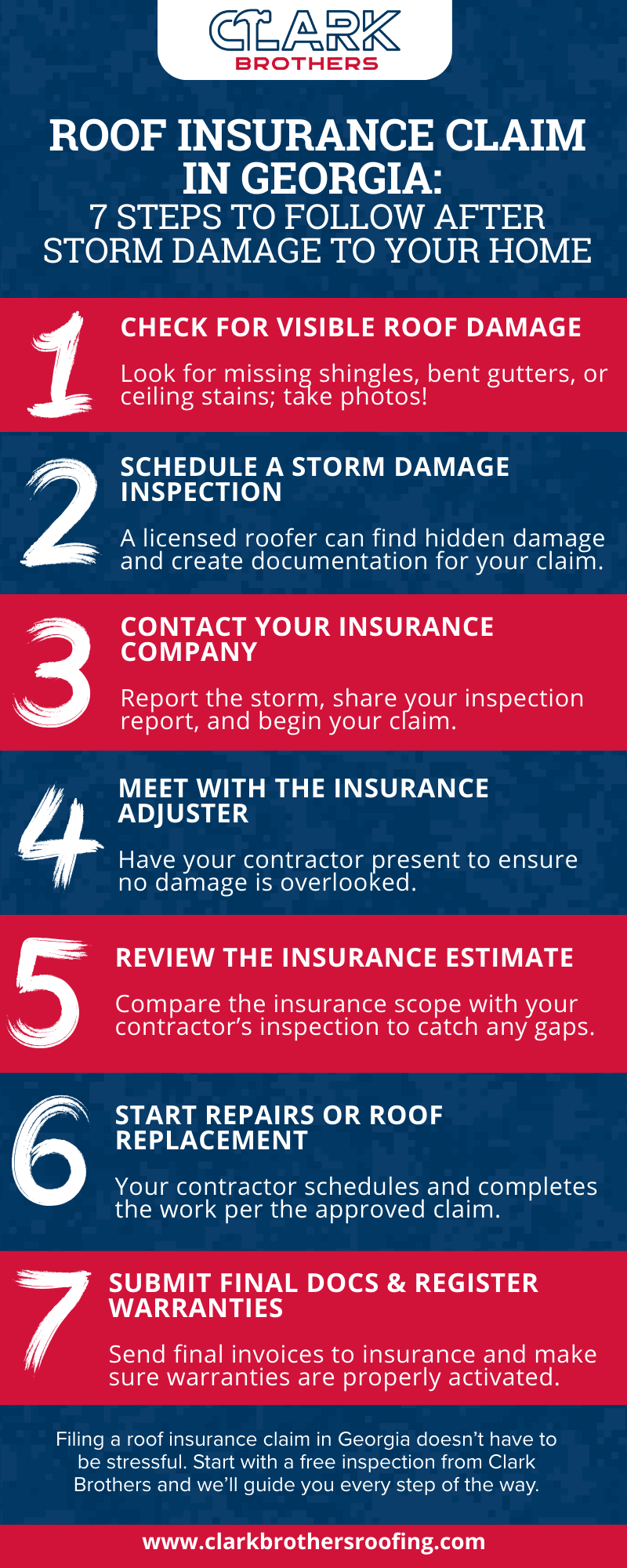

Step 1 – Check for Roof Damage (Safely)

Once the weather clears, walk around your property and take a look from the ground. You don’t need to climb a ladder or risk getting up on the roof. Just keep an eye out for anything that looks out of place.

Some of the most common signs of damage include missing shingles, pieces of roofing material on the ground, bent or broken gutters, and water stains on ceilings inside your home. If you see anything that makes you pause, take photos. Even if the damage seems small, it’s worth documenting.

Step 2 – Get a Storm Damage Roof Inspection

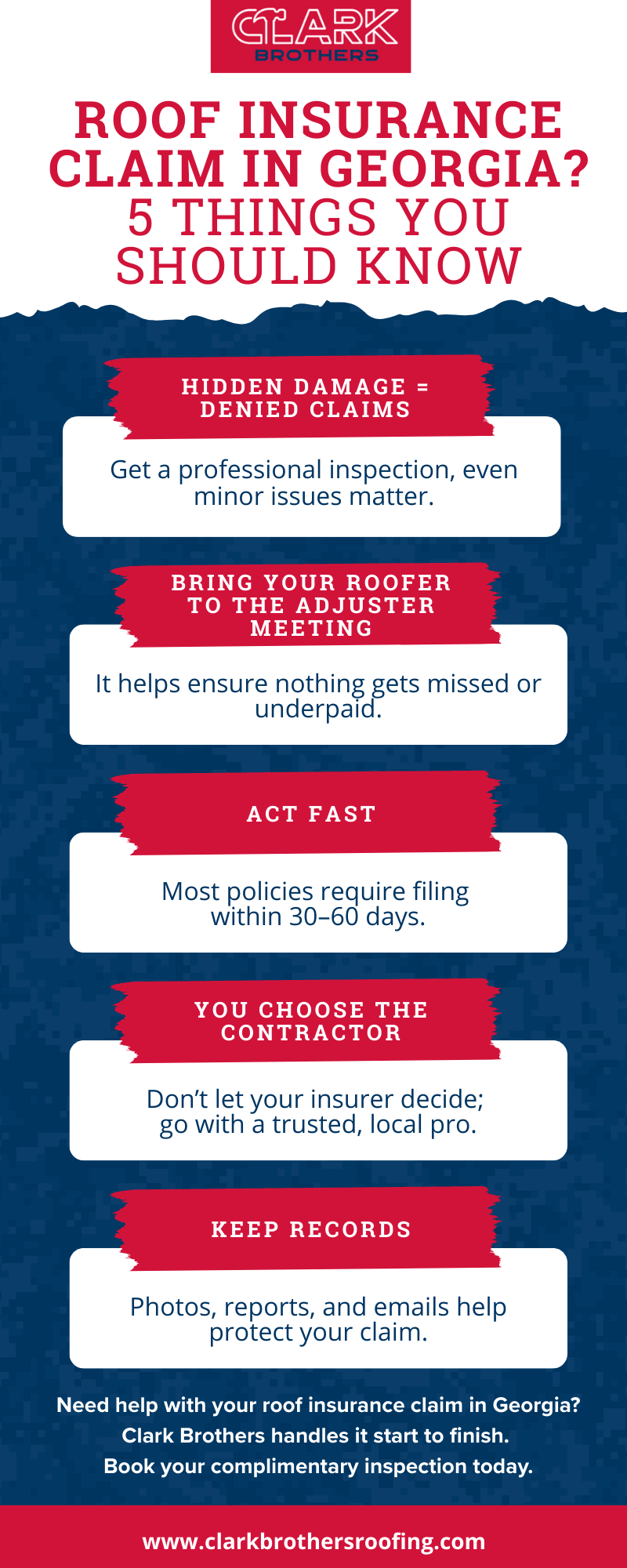

Even if you spot a few obvious issues, there’s a good chance more is going on than what you can see from the ground. A proper roof inspection goes deeper, checking the full system for lifted shingles, soft spots, punctures, and other hidden damage that insurance needs to account for.

An experienced roofer will provide a detailed report and photos. That inspection is what gives you a clear picture of the damage and helps support your claim.

Step 3 – Contact Your Insurance Provider

Once you’ve confirmed damage, reach out to your insurance company to start the claim process. Most policies require that claims be filed quickly, so it’s better to act sooner rather than later.

You’ll likely be asked when the storm occurred, what type of damage happened, and whether you have photos or inspection documentation. Just give them the basics for now. You don’t need to have all the answers on day one.

Step 4 – Meet with the Insurance Adjuster

Your insurance provider will schedule a visit with an adjuster to assess the damage. This is where having your roofing contractor on-site can make a big difference. A contractor can walk the adjuster through everything that was found during the inspection and help ensure nothing gets missed.

When the roofer and the adjuster are aligned, your estimate is more likely to cover everything needed to restore your roof properly.

Step 5 – Review the Estimate from Insurance

After the adjuster’s visit, you’ll receive an estimate showing what the insurance company will cover. This includes materials, labor, and your deductible.

Take time to review it. Look for any missing items or anything that doesn’t seem to match the damage found during your inspection. If something feels off, bring it to your contractor. A good roofer will help you compare the estimate to the real scope of work and make sure your insurance company has all the right information.

Step 6 – Schedule the Roof Replacement or Repairs

Once the claim is approved, it’s time to get your roof back in shape. Your contractor will schedule the work, coordinate materials, and complete the project based on the scope that was approved.

If anything unexpected is uncovered once the roof is opened up, like damaged decking or rotted wood, your contractor can document it and submit that information for additional coverage through a supplemental claim.

Step 7 – Submit Final Documents and Register Warranties

When the project is finished, your insurance provider may request final paperwork and photos to release the remaining portion of your claim payment. This usually includes an invoice from the contractor and proof that the work was completed.

You should also make sure your warranties are registered properly. That includes both the materials used and the workmanship guarantee, if one is offered.

Common Mistakes to Avoid When Filing a Roof Insurance Claim in Georgia

It’s your home, and you have the right to choose who works on it. Be cautious of anyone who shows up at your door after a storm offering a deal that feels too good to be true. Stick with licensed, local contractors who know Georgia homes and understand how to work with insurance carriers.

Keep records of everything throughout the process, from inspection photos to emails with your adjuster. If anything comes up later, you’ll be glad you have it.

Need Help Filing Your Roof Insurance Claim in Georgia?

Storm damage can turn your week upside down, but getting your roof repaired shouldn’t add more stress. At Clark Brothers, we walk homeowners through this process every day. Our team handles detailed inspections, works directly with insurance adjusters, and restores roofs with quality that lasts.

We’re a veteran-owned, family-run company rooted in integrity and built to serve. Most roof replacements are completed in just one day, and every project is handled with care and precision.

If you’re unsure where to begin, start by scheduling your complimentary roof inspection. We’ll take it from there and make sure you’re covered, start to finish.

Schedule your free inspection today and take the next step toward restoring your home with confidence.