Storms in Metro Atlanta can transform a peaceful afternoon into a homeowner’s nightmare in a matter of minutes. High winds, golf-ball-sized hail, and fallen trees often leave behind uncertainty and the pressing need for roof repairs.

If your roof has been compromised by a storm, understanding how to navigate insurance claims for roof storm damage is essential. Knowing what steps to take, how to communicate with your insurer, and when to involve a roofing professional can make the difference between a smooth recovery and a costly misstep.

Insurance Claims for Roof Storm Damage: What Homeowners Should Know

Before you file a claim, it’s important to understand how your insurance policy works. Most homeowners have either a Replacement Cost Value policy or an Actual Cash Value policy.

Replacement Cost Value (RCV) policy: Your insurance company will pay to replace your roof with new materials that match what you had. You will still need to pay your deductible, but this type of policy typically covers most of the cost to restore your roof to its original condition.

Actual Cash Value (ACV) policy: Pays you based on what your roof is worth today, not what it would cost to replace it. The value goes down over time as your roof gets older and wears out. That means you could receive less money for repairs, especially if your roof is more than a few years old.

It’s also important to check your deductible and see if your policy has any limits or exclusions related to storm damage. Some policies do not cover issues caused by old age or lack of maintenance, so keeping your roof in good condition can make a big difference if you ever need to file a claim.

Types of Roof Storm Damage Typically Covered by Insurance

While each policy differs, here are the most commonly covered types of storm-related roof damage:

- Hail Damage: Small dents, cracked shingles, or bruising to asphalt shingles.

- Wind Damage: Torn or missing shingles, damaged flashing, or lifted roof edges.

- Impact Damage: Fallen limbs or flying debris that puncture or dislodge roofing materials.

- Water Intrusion: Leaks caused by sudden storm damage, not ongoing wear.

The Roof Storm Damage Insurance Claim Process: Step-by-Step

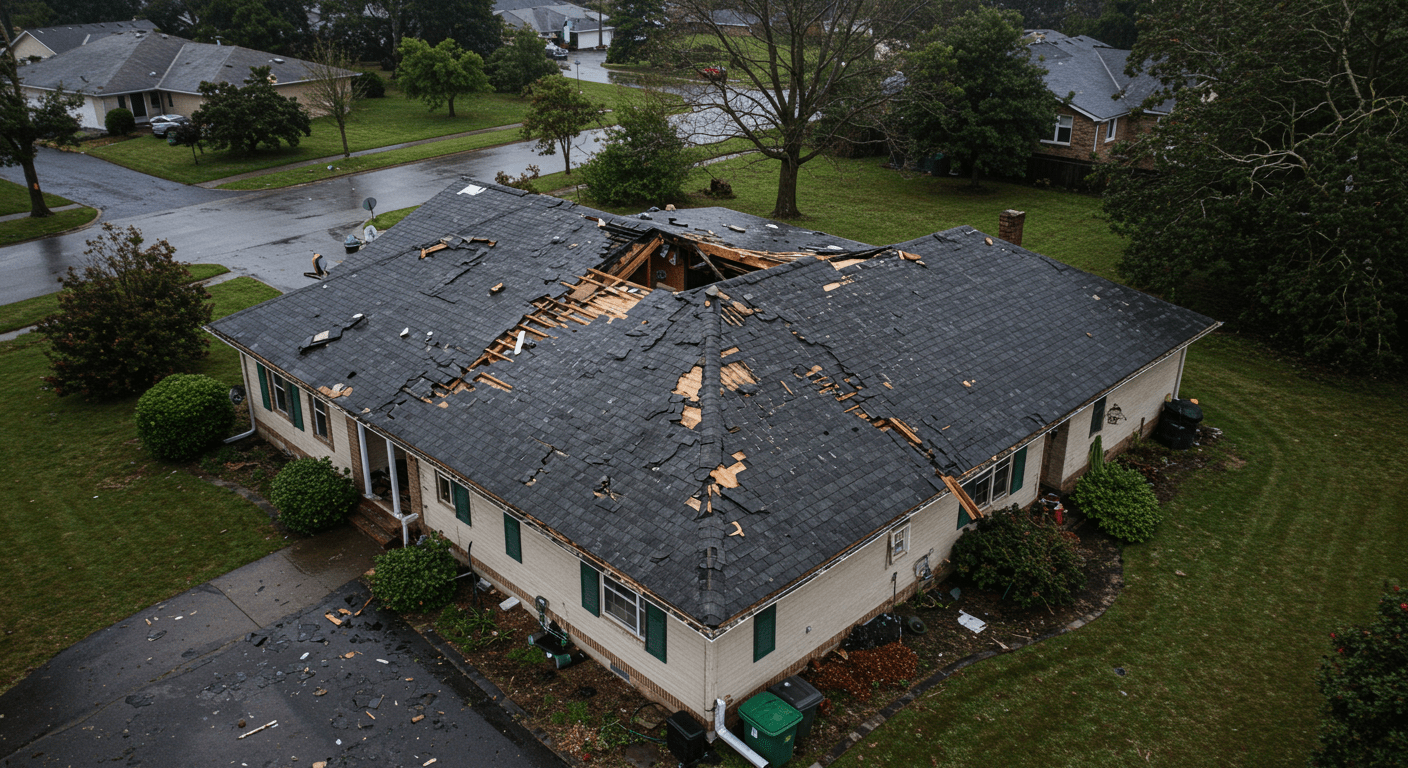

Step 1: Conduct a Safe Preliminary Check

Once the storm has passed and it’s safe, walk the perimeter of your home. Document any visible damage with clear, timestamped photos. Focus on shingles, gutters, siding, and any interior water intrusion.

Step 2: Contact a Licensed Roofing Professional

Reach out to a trusted contractor—ideally one who is experienced in insurance work. At Clark Brothers, we provide detailed inspection reports that can strengthen your claim and uncover hidden issues.

Step 3: Notify Your Insurance Company

File your claim promptly. Many policies require that you report damage within a specific window (often 30–60 days). Send your photos and the contractor’s report to initiate the process.

Step 4: Meet the Adjuster

Your insurance provider will send an adjuster to assess the damage. Having your contractor present ensures nothing gets overlooked. Our clients often tell us this step is where our team truly makes a difference.

Step 5: Review the Settlement

Once your insurer sends a summary of the claim, compare it to your contractor’s estimate. Look for discrepancies in scope or pricing and don’t hesitate to ask questions.

Step 6: Proceed with Repairs

Only move forward with non-emergency repairs after your claim is approved. Work with a contractor who understands claim documentation to ensure repairs align with your policy.

How to Prepare Before a Storm to Make Insurance Claims Easier

Getting ahead of storm season can make things a whole lot easier if damage happens. One of the simplest things you can do is take a few photos of your roof and the outside of your home once a year. These come in handy if you ever need to show your insurance company the difference between what things looked like before and after a storm. It’s also smart to keep your insurance policy and your go-to contractor’s info in a spot that’s easy to grab if you ever need it. And don’t wait until bad weather is on the radar—take a few minutes now to look over your policy so you know what’s covered and what’s not.

How Roof Storm Damage Insurance Claims May Affect Your Premium

A lot of folks worry that filing a claim will raise their insurance rates. The good news is that most storm damage claims are treated differently from claims for other issues, like water leaks from poor maintenance. If a big storm rolls through and your whole neighborhood is affected, your claim might be seen as part of a larger event, not just a one-off issue. Still, it’s always a good idea to check with your agent and ask how a storm-related claim might impact your premium. That way, you can make an informed decision without second-guessing.

What to Look for in a Contractor When Navigating Roof Storm Damage Insurance Claims

When it comes to storm damage and insurance claims, the contractor you choose matters. You want someone who’s licensed, insured, and knows how to work with insurance companies—not just someone who can swing a hammer. Look for a team that gives you clear estimates, shows up when they say they will, and doesn’t pressure you into signing something before you’re ready. Having a contractor who knows how to document damage and speak the language of adjusters can make the whole process smoother and help you get the coverage you deserve.

Tips for a Smoother Insurance Claim for Roof Storm Damage

If you’re dealing with storm damage, a little organization goes a long way. Keep a notebook or email folder with details of every conversation you have about your claim—who you talked to, what was said, and when. If your roof is leaking or damaged, take steps to prevent more damage, like covering it with a tarp until repairs can be made. And if something in your settlement doesn’t feel right, speak up. You’re allowed to ask questions, push back, or bring in a contractor to take a second look.

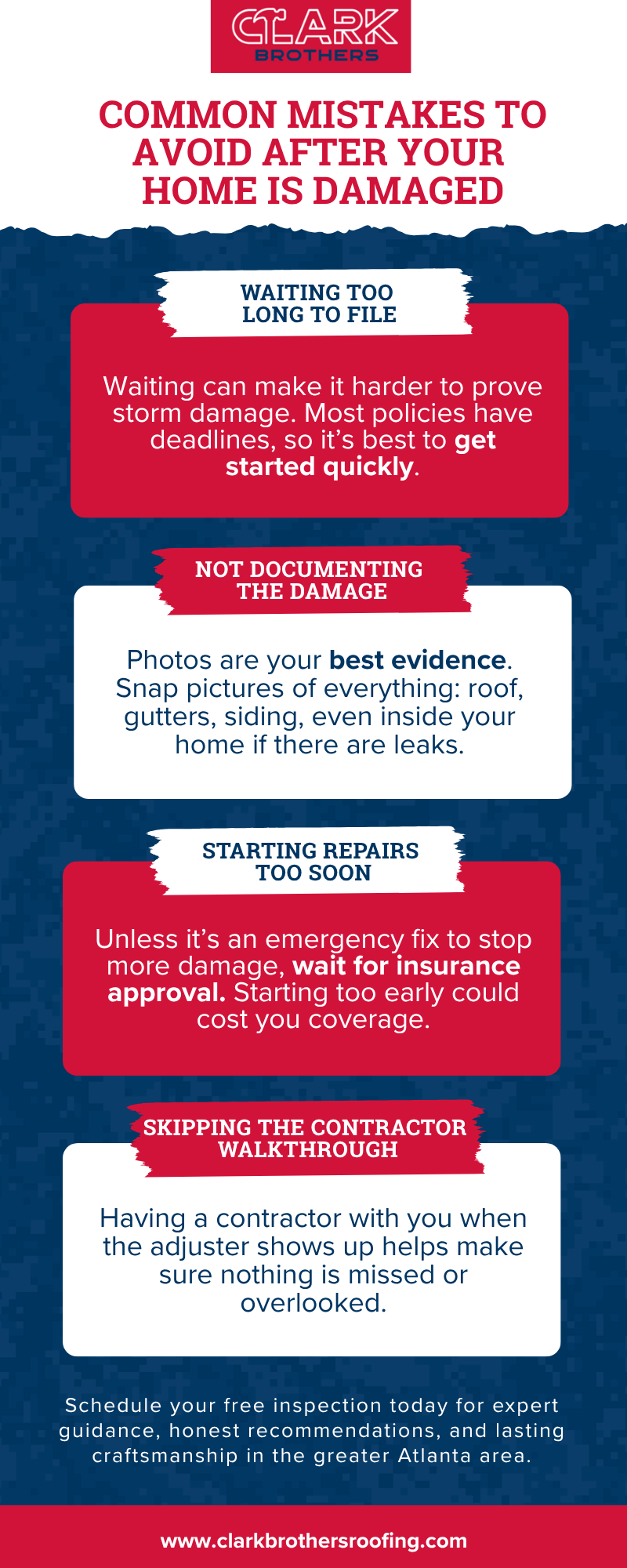

Common Mistakes to Avoid After Your Home Is Damaged

Filing a roof insurance claim isn’t something most people do often, and small missteps can cause big headaches later. Here are some of the most common mistakes we see homeowners make and how to stay clear of them.

- Waiting Too Long to File

Waiting can make it harder to prove storm damage. Most policies have deadlines, so it’s best to get started quickly. - Not Documenting the Damage

Photos are your best evidence. Snap pictures of everything—roof, gutters, siding, even inside your home if there are leaks. - Starting Repairs Too Soon

Unless it’s an emergency fix to stop more damage, wait for insurance approval. Starting too early could cost you coverage. - Skipping the Contractor Walkthrough

Having a contractor with you when the adjuster shows up helps make sure nothing is missed or overlooked.

Not Sure About Your Claim? Here’s What to Do Next

If your settlement seems low or something just doesn’t feel right, trust your instincts. A second opinion from an experienced roofing professional can reveal damage that may have been missed during the initial inspection. In many cases, that’s all it takes to reopen your claim and get the coverage you deserve.

If you’re in that situation now, or just want a second set of eyes before moving forward, schedule a complimentary inspection with Clark Brothers. We’ll walk you through what we see, explain your options clearly, and make sure nothing gets overlooked. No pressure, just honest answers and trusted help when you need it most.

Click here for our ultimate guide to improving your home’s exterior.